Economy & Indian Festivals: Cultural Rhythms, Economic Impacts

GET FULL REPORTIndia is a land where every month brings a new reason to celebrate. Festivals are woven into the very fabric of our lives — vibrant threads of joy that unite communities and spark waves of happiness across the nation. Yet, beyond these celebrations lies a deeper rhythm: one where culture drives commerce and tradition fuels economic growth.

From Ugadi to Diwali, each festive season ignites demand, shapes retail strategies, and propels India's economic momentum.

Explore our latest KGS Report to discover how festivals influence GDP, transform industries, and offer powerful insights for policymakers and businesses worldwide.

It's a compelling read on how culture and economy move in perfect harmony.

Anti-Abuse tax provisions – GAAR, PPT and others

GAAR has been framed into the domestic law allowing tax authorities to counteract arrangements that are impermissible because their main purpose is to obtain a tax benefit and they lack commercial substance.

(i) Legislative Framework of GAAR under Income tax Act, 1961 has been provided below:

- Section 96: Defines Impermissible Avoidance Agreement (“IAA”) - where the main purpose is obtaining a tax benefit, and at least one tainted element is present:

- Rights or obligations not at arm’s length

- Misuse/abuse of Act provisions

- Absence of commercial substance

- Not for bona fide purposes

- Section 97: Provides the conditions under which an arrangement is considered as lacking commercial substance, e.g., round trip financing or artificial steps in a structuring arrangement.

- Section 98: Grants Assessing Officer (AO) authority to recharacterize or ignore part/all of the arrangement, re-compute income.

- Section 99: Defines the computation of "tax benefit"—including reductions, deferment, refunds, or usage under treaties.

- Section 100: Clarifies that GAAR applies in addition to (and may override) other provisions.

(ii) Supporting Circulars & Clarifications

- CBDT Circular No. 7/2017 (27 Jan 2017):

- GAAR and SAAR can coexist; neither excludes the other.

- GAAR won't apply if Limitation of Benefits (LoB) clause under treaty already addresses avoidance.

- Jurisdiction decisions based on non-tax commercial considerations are outside GAAR scope.

- Grandfathering allowed for investments pre 1 April 2017—including bonus shares, CCPs, split/shares generated.

- CBDT Circular 01/2025 (21 Jan 2025):

- Clarified that the Principal Purpose Test (PPT) under DTAA applies prospectively only.

- GAAR, SAAR, and judicial anti-abuse rules operate independently, unaffected by PPT guidance.

B .Principal Purpose Test (PPT)

The Principal Purpose Test (PPT) is a broad anti-abuse rule embedded in India’s tax treaties through the Multilateral Instrument (MLI) to curb treaty-shopping and align with OECD BEPS Action 6. PPT is a minimum standard. Under PPT, treaty benefits must be denied if it is reasonable to conclude that obtaining such benefit was a principal purpose of any arrangement unless the taxpayer proves that granting the benefit is consistent with the object and purpose of the applicable treaty provision.

India has implemented the PPT via the MLI across most of its double taxation avoidance agreements (DTAAs) (covering over 90 treaties), and in some cases, through bilateral protocols - for instance with Hong Kong, Chile, Iran, etc.

C. Structures where GAAR and PPT can be applicable

We have highlighted below some of the structures where the provisions of GAAR and PPT might get triggered:

| Structure | Applicability of GAAR and PPT |

|---|---|

| Conduit Arrangements - Global group sets up an intermediate entity in Singapore to route investments into India for capital gains exemption. | GAAR: If entity lacks substance (no employees, no real decision-making), GAAR applies. PPT: Treaty benefit denied unless commercial rationale proved. |

| Round Trip Funding - If an Indian promoter indirectly invests into India through an offshore SPV (Mauritius) solely to claim treaty benefits without genuine offshore substance | GAAR: If the Mauritius entity is a shell with no employees, or decision-making power, GAAR applies - lacks commercial substance

PPT: Under MLI, treaty benefit denied if principal purpose is tax advantage and offshore SPV lacks substance. |

| Foreign EPC contractor splits a large project into multiple short-term contracts through related entities to avoid PE threshold. | GAAR: Recharacterize contracts as a single arrangement. PPT: Treaty benefit (e.g., lower WHT) denied since splitting was primarily for tax avoidance. |

| Indian company merges with a foreign entity incorporated in a low-tax jurisdiction, primarily to access treaty benefits for future capital gains. | GAAR: Trigger if Main purpose = tax benefit and lacks commercial substance. PPT: Treaty benefit (e.g., reduced withholding tax) denied if merger is for tax advantage without commercial rationale |

| Group demerges Intellectual property (IP) into a foreign subsidiary to reduce royalty withholding tax. | GAAR: If IP transfer lacks commercial substance, GAAR applies.

PPT: Treaty benefit on royalties denied if principal purpose is tax savings. |

Key points to consider in Restructuring – from GAAR and PPT perspective

- Substance first. Build genuine functions (management, risk, capital, people) into holding entities; minute decisions etc.

- Purpose memo. For every reorganization, keep a memo outlining non tax objectives (synergy, regulatory, governance, market access).

- Treaty hygiene. Test PPT before claiming relief; align facts with treaty object/purpose.

- Dispute readiness. Document facts consistent with Azadi/Vodafone principles; avoid McDowell hallmarks (colourable devices).

D.Judicial precedents – Substance over form

We have highlighted a few judicial precedents which provide that colourable structures would be disregarded and not eligible for tax benefits:

- Azadi Bachao Andolan v. Union of India (Supreme Court, 2003) – highlighted on “beneficial ownership”, held that mere legal title doesn't grant treaty benefits. Entities serving as conduits are ineligible for treaty relief.

- McDowell & Co. case emphasized that colourable devices and dubious methods can be disregarded—signalling a purposive approach against evasion.

In addition to GAAR and PPT, both Income-tax Act and tax treaties use anti-abuse provisions like limitation of benefits clause, beneficial ownership clause, thin capitalization provisions etc.

In the post MLI and GAAR era, tax structuring must be purposeful and substantive. Structures that are form driven, short term, or conduit like are high risk under both PPT and GAAR; those with real business functions, long term presence, and documented rationale remain defensible.

DPDP Act Roadmap: Safeguarding Sensitive Employee Information

The face of regulations in India for employers has taken a drastic turn since the notification of the Digital Personal Data Protection Act, 2023 (hereinafter referred to as “DPDPA”) and the Labour codes. Prior to the DPDPA being notified, the single regulation guiding the processing of employee personal data in India was the Information Technology (Reasonable Security Practices and Procedures and Sensitive Personal Data/Information) Rules, 2011 (hereinafter referred to as “SPDI Rules”), wherein consent was the sole mechanism for processing “sensitive personal data”. However, the DPDPA has brought certain relief to employers in terms of processing personal data of its employees. In this article we discuss the key obligations of an employer and provide a roadmap for phased implementation of the same into the daily operations of companies.

Key Obligations:

- Players: The DPDPA defines three-players under the guise of regulation, one Data Principal, i.e., the person whose personal data is being collected; two, Data Fiduciary, i.e., person who determines the purpose of processing data, viz the employer; and lastly, Data Processor, i.e., persons who process personal data on behalf of the employer/Data Fiduciary.

- Personal Data: Unlike in the SPDI rules, the definition of “personal data” is not an exhaustive list. Under the DPDPA, “personal data” has an expanded scope of application as it applies to all data that identifies the Data Principal. So, Personal Data would include employment agreement, Aadhar card details, educational certificate, background verification reports, etc.

- Consent: Under DPDPA, prima facie, processing of data is consent based. However, the Act enumerates an exhaustive list of “legitimate use” wherein the consent is deemed. This “Legitimate use” includes processing of data for employment purposes. That is to say that the employers need not obtain express consent for processing employee data.

- Retention: Data retention is purpose based, and time-limit driven. Certain data can be deleted once the purpose of processing is completed unless, retention is necessary for compliance with any law. In specific, tax laws, corporate compliance obligations, labour laws, and litigation considerations provide for varying retention periods. Hence, corporates must adopt effective internal policy to avoid creating data junkyard and excessive cost of safely securing data.

- Security Measures: The DPDPA mandates implementation of security measures such as encryption, obfuscation, controlling access to computer resources, monitoring access of personal data, and effective safety safeguards.

- Grievance redressal and POC: The DPDPA requires Company to establish mechanism to redress grievance regarding processing of personal data. The DPDP Rules further require every Data Fiduciary to display on its website or app clear contact information for queries related to processing personal data. This may be the contact of a designated officer or a Data Protection Officer.

- Significant Data Fiduciaries: The Government is yet to roll-out the list of establishments or class of establishments classified as significant Data Fiduciaries. The Significant Data Fiduciaries have stricter obligations such as appointment of Data Protection officer, conducting regular audits and periodic assessments.

Roadmap for Implementation:

- Immediate Action Points – First step in compliance begins with understanding the personal data being handled by your organisation. Identify every single personal data being collected by your organisation and create a data inventory. Based on the data inventory consult your lawyers to understand the necessary compliance under DPDPA.

- Action items by May 2027 – Ensure to establish clear privacy policies, notices and consent log, adopt security measures, train employees, maintain records, establish grievance redressal, retention and deletion policies, report any breach of personal data etc.

- On-going action points – Compliance demands continuous effort, not an one-time effort—it's a sustained cultural transformation. Routinely assess and refine your privacy framework to address emerging challenges and evolving regulations.

Conclusion:

In conclusion, the DPDPA ushers in a transformative era for employee data governance in India, alleviating consent burdens whilst imposing robust obligations on employers as data fiduciaries. By embracing the outlined roadmap—from data inventory and policy formulation to ongoing audits and cultural integration—companies can mitigate risks, ensure compliance, and foster trust. Proactive adherence not only averts huge penalties but also positions organizations as leaders in ethical data stewardship amid evolving regulations.

- The Employers get relief under DPDPA due to the “deemed consent” mechanism for processing employee personal data.

- Companies must follow a phased roadmap—starting with immediate data inventory and ongoing cultural shifts in privacy practices—to meet obligations like security, retention, and grievance redressal.

FEMA Compliance for Pre-Incorporation Expenses: A Practical Guide for Foreign Businesses Entering India

Expanding into India is an exciting growth opportunity—but it’s not without its regulatory hurdles. One area that often trips up global businesses is pre-incorporation expenses—those costs incurred before your Indian subsidiary is officially registered.

Think office rentals, security deposits, consultancy fees, and legal charges. While these seem routine, they fall under the Foreign Exchange Management Act (FEMA), 1999, which governs all cross-border financial dealings.

Ignoring FEMA compliance can lead to penalties, delays, and reputational risks. So, let’s break down what you need to know .

Why FEMA Compliance Matters

FEMA was designed to regulate foreign exchange transactions and maintain India’s financial stability. Any payment from a foreign entity to an Indian resident—even before incorporation—must comply with FEMA guidelines. Misclassification or improper reimbursement can result in violations, making proactive planning essential.

What are the common hurdles observed?

For overseas companies setting up shop in India, helping the new subsidiary cover initial expenses feels logical and straightforward. There is an obvious need to pay for office space, legal fees, and consultants before the business starts generating revenue.

But here’s the catch: in the chaos of incorporation and operational setup, FEMA compliance often gets sidelined. It doesn’t seem urgent—until the Indian entity tries to reimburse the foreign parent. That’s when the roadblock appears. Banks and regulators scrutinize these transactions, and if documentation or categorization isn’t right, reimbursements can be delayed or even rejected.

The lesson? Plan FEMA compliance from day one. Clear agreements, proper categorization of payments, and early engagement with your Authorized Dealer (AD) bank can save you from costly surprises later.

Quick checklist to keep in mind from the very beginning –

- Nature of Payment

- Indian residents generally cannot accept deposits from non-residents unless specifically permitted by RBI. A simple mislabelling by an accounts personnel where advance rent or service fees is tagged as “deposit” can trigger compliance issues.

- Reimbursement Restrictions

- RBI approval is mandatory if reimbursement exceeds 5% of the investment or USD 100,000, whichever is higher.

- Documentation Gaps

- Agreements often fail to clarify that payments are made on behalf of the soon-to-be incorporated entity, complicating compliance.

- Direct Vendor Payments

- If the foreign parent pays Indian vendors directly, invoices must clearly reflect the Indian entity’s details. Missing this can block reimbursements.

- Set-Off Restrictions

- oPre-incorporation expenses cannot be offset against operational receipts later.

Small steps now = big savings later. Don’t let compliance derail your India entry strategy. Engage with the AD Bank from the start and have documentation with precise terms.

What are the different ways to reimburse an overseas entity?

If your Indian subsidiary isn’t generating enough revenue to settle pre-incorporation expenses, there’s another alternative—convert those payables into equity. This route often makes sense because, in most cases, the overseas parent already holds the majority stake. However, this isn’t just an accounting adjustment; it triggers FDI compliance requirements under FEMA.

Approvals, reporting timelines, and sectoral caps come into play, and you’ll need to follow RBI guidelines for capitalization. Done right, this approach strengthens the subsidiary’s balance sheet and avoids cash flow stress—while keeping your India entry fully compliant.

1. Direct Reimbursement

- Requires RBI approval if thresholds are exceeded.

- Must route through authorized banking channels.

- Supporting documents like rental agreements, invoices, and auditor certifications are essential.

2. Capitalization into Equity

- Allowed under the automatic route for sectors with 100% FDI approval.

- Expenses can be converted into equity instruments within prescribed limits:

- Up to 5% of authorized capital or USD 500,000, whichever is lower.

- Reporting to RBI via Form FC-GPR within 30 days of issuance.

Final Thoughts

Pre-incorporation costs may look small, but mishandling them can derail your India entry strategy. Structuring agreements properly, maintaining documentation, and following RBI guidelines are non-negotiable for a smooth start. Ignore this, and you risk more than delayed reimbursements—foreign payables sitting on your balance sheet beyond prescribed timelines can trigger FEMA non-compliance. Best way to stay compliant is to assess every forex transaction from day one. It’s easier to plan upfront than to fix compliance gaps later.

- The article provides a quick snapshot for newly incorporated subsidiaries in India when they receive financial support from their overseas parent entities

- FEMA governs such transactions and ensuring adherence helps seamless reimbursement processes

Relevance of Regulatory Landscape in Shaping the Valuation Approach

Regulations as a Determinant for Valuation Judgments

Determining the optimal valuation methodology requires a rigorous alignment of the company’s business continuity, financial health, and the economic environment in which it operates. Based on these factors, the valuer decides on the application of either the Income Approach, Market Approach, or Asset Approach to determine a company’s valuation.

The Income Approach serves as a forward-looking lens, best suited for stable, cash-generating businesses where value is derived based on future earnings capability. The Market Approach provides a practical benchmark by comparing the company against peers operating in similar active markets. Asset Approach works where business continuity is uncertain or focusing on underlying assets is more important than considering speculative growth.

Selecting the appropriate valuation approach is therefore not just about following the conventional rules, but it also depends on the business situation and regulatory environment.

Regulatory Landscape as a Valuation Sensitivity

While valuers generally factor in historical performance, business outlook, capex and borrowing plans, regulatory developments often remain underweighted despite their ability to materially alter valuation outcomes. Regulatory changes can directly impact cost structures, revenue drivers, operational flexibility, and investor risk perception — all of which flow into valuation assumptions.

In regulated industries, failure to anticipate regulatory shifts or assess compliance readiness can result in optimistic projections that may quickly become unsustainable. Let’s look at a few examples below:

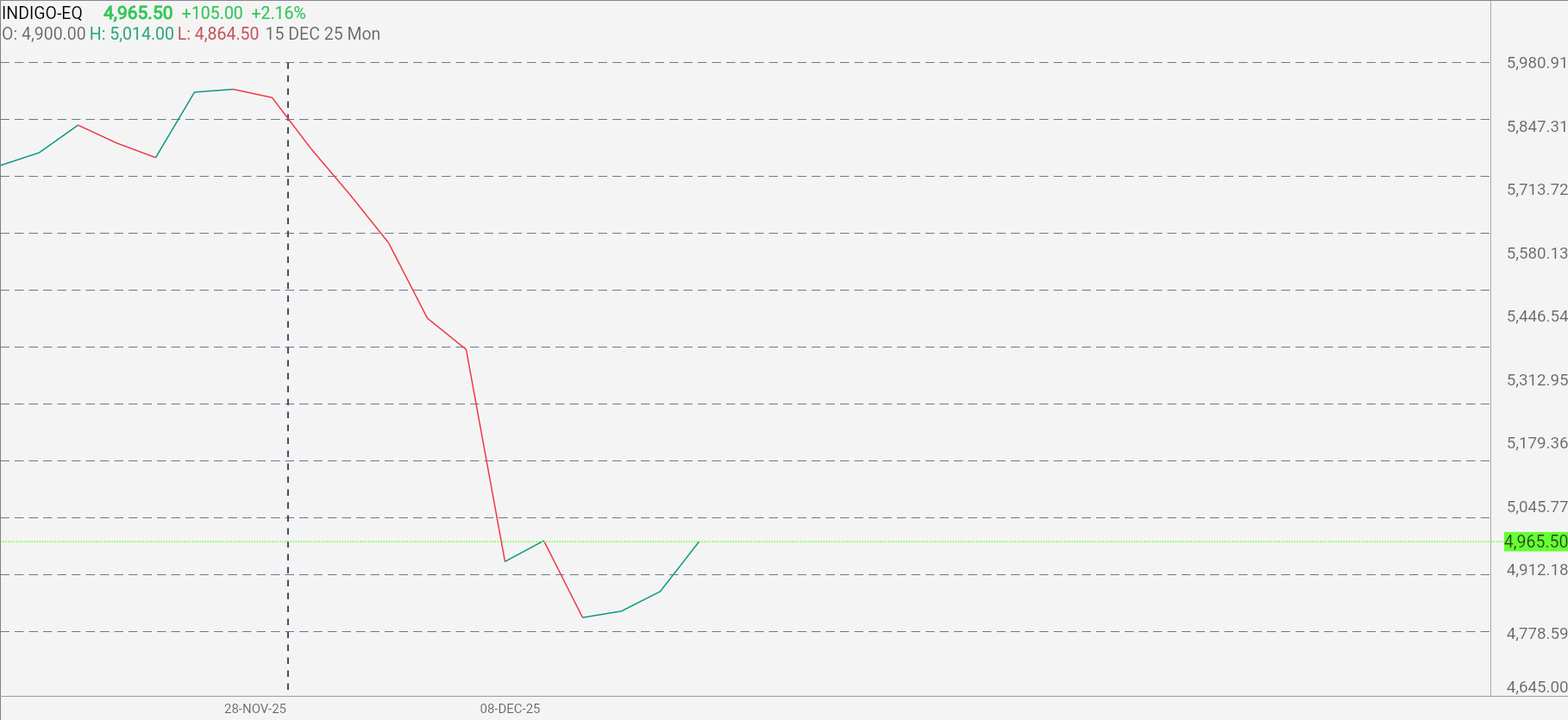

1.IndiGo: Regulatory Preparedness and Earnings Visibility

Consider the example of IndiGo, India’s largest airline by market share. The revised Civil Aviation Requirements (CAR) relating to Flight Duty Time Limitations (FDTL) issued by the DGCA materially altered operational realities in Indigo’s case.

Following the implementation deadline, IndiGo faced widespread flight cancellations driven by pilot availability constraints and scheduling challenges. Despite a transition window of nearly two years, operational preparedness proved insufficient, leading to network disruption and adverse market reaction. Analysts responded by materially revising earnings expectations downward, reflecting heightened uncertainty around execution capability and cost escalation.

The impact of this was clearly visible on the market price of Indigo’s share.

Source: NSE

This episode demonstrates how regulatory preparedness materially affects earnings visibility and the risk assumptions embedded in valuation models.

2.Paytm Payments Bank: Regulatory Non-Compliance and Going-Concern Risk

While some regulatory changes lead to downward valuation adjustments, others fundamentally challenge business continuity. Paytm Payments Bank (PPBL) provides a compelling illustration. Persistent compliance shortcomings culminated in the Reserve Bank of India (RBI) imposing severe operational restrictions in early 2024, including a prohibition on accepting new deposits.

The regulatory action had immediate spillover effects on its parent entity, One97 Communications, with the stock declining sharply within days, erasing substantial market cap.

Source: NSE

The restriction on deposit inflows materially impaired the bank’s revenue engine and raised concerns regarding the sustainability of its business model. From a valuation standpoint, such intervention introduces material uncertainty around the entity’s ability to continue as a going concern. Businesses that could earlier be valued using Income or Market approaches may now need reassessment under the Asset Approach, where recoverability of tangible assets takes precedence over uncertain future cash flows.

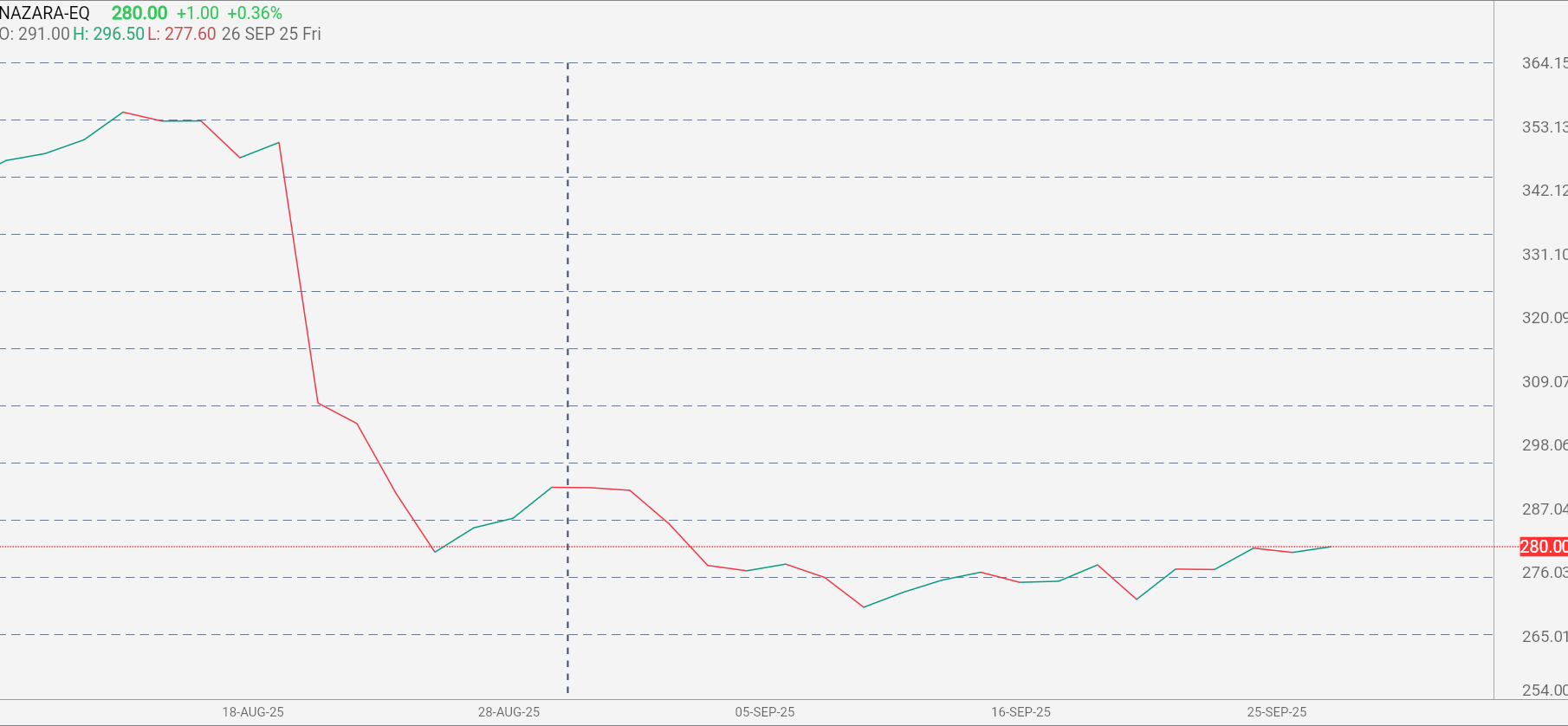

3.Online Real Money Gaming: Industry-Wide Regulatory Shifts

Regulatory risk is not limited to individual companies; it can reshape entire industries. For instance, India’s Online Real Money Gaming (ORMG) sector, once a fast-growing market with hundreds of start-ups and a significant share of investor funding, faced severe disruption following the introduction of the Promotion and Regulation of Online Gaming Act (PROGA), 2025.

The revised regulatory framework curtailed real-money gaming activities, leading to operational shutdowns, lay-offs, and erosion of enterprise value across the sector. An industry which was projected to grow rapidly over the medium term instead faced severe uncertainty around business continuity and future viability due to regulatory interventions.

For instance, this change curtailed the operations of Pokerbaazi considerably, and the impact of this change was clearly visible on stock prices of Nazara Technologies, who was one among the major investors.

Source: NSE

Such developments make historical growth trajectories and comparable market multiples largely irrelevant, forcing valuers to reassess assumptions, increase risk premiums, and, in certain cases, reconsider the choice of valuation methodology altogether.

Regulatory Influence on Valuation Approach Selection

Above examples reinforce that regulatory developments influence not only valuation outcomes, but also the appropriateness of valuation approaches:

- Income and Market Approaches rely on regulatory stability, predictable cash flows, and business continuity.

- Asset Approach gains relevance when regulatory action threatens business and revenue sustainability or introduces going-concern uncertainty.

- Regulatory non-compliances also often necessitate adjusting the valuation assumptions like higher discount rates, compressed valuation multiples etc.

Conclusion: Regulatory Landscape as a Core Valuation Variable

Ultimately, valuation outcomes are shaped not only by business strategy, historical performance, and capital investment, but also by the regulatory landscape and the target company’s compliance readiness. Regulatory changes have the power to alter revenue models, invalidate projections, and redefine risk profiles.

For valuation professionals, regulatory awareness must extend beyond mandatory disclosures. Continuous monitoring of regulatory developments, assessment of compliance preparedness, and timely incorporation of regulatory risk into valuation models are essential to ensure that valuation methodologies, assumptions and outcomes are both analytically sound and professionally defensible.

Valuation should always be undertaken considering the regulatory landscape in which the company operates. Overlooking regulatory risks can significantly impact assumptions, outcomes, and even the choice of valuation approach.